Basically, there is no significant difference between loans and debts, all loans are part of a big debt. . The money lent to the public through the issuance of bonds and notes is considered debt. In simple words, the money borrowed from a lender is a loan, and through bonds, debentures, etc. Money borrowed is the debt.

Is a loan a debt??

Loans, bonds, notes and mortgages are all types of debt. In finance, debt is one of the most important financial instruments, especially in contrast to equity capital. The term can also be used metaphorically to cover moral obligations and other interactions that are not based on a monetary value.

What are the four types of debt?

The main types of personal debt are secured debt, unsecured debt, revolving debt, and mortgages. Secured debt requires some form of collateral, while unsecured debt is based solely on a person's credit score.

What is a debt example??

Debt is defined as money owed, money owed that is past due, or feeling like you owe someone something. An example of debt is what you owe on your mortgage and car loan. An example of debt is feeling grateful when someone helps you go to college.

What is a loan?

A loan is a form of indebtedness of an individual or another company. The lender – usually a business, financial institution, or government – transfers an amount of money to the borrower. In exchange, the borrower agrees to a number of terms, including any finance charges, interest, repayment date and other conditions.

What types of debt should be avoided?

- Credit card debt. With credit cards promising a luxurious and worry-free lifestyle, it's no surprise that many people have fallen into a credit card debt cycle. .

- Student Loan Debt. .

- Medical debts. .

- Car loan debts.

How much debt is healthy?

A good rule of thumb for calculating a reasonable debt load is the 28/36 rule. According to this rule, households should not spend more than 28% of their gross income on household expenses. This includes mortgage payments, homeowners insurance, property taxes and condo / POA fees.

What are the most common debts?

There are many different types of consumer debt. The most common debts collected by debt collectors are credit card debt, medical debt and student loan debt. There are others, such as personal loans, cell phone bills, utility bills, overdraft fees, car loans, payday loans, to name a few.

What are the 3 Cs of credit??

Examining the C's of Credit

For example, when it comes to actually applying for a loan, the "three Cs" of credit – capital, capacity and character – are critical.

How can I be debt free??

- Use your tax refund check to pay off debts. .

- Selling items for cash. .

- Consider cashing in your life insurance policy. .

- Making more money. .

- Make a transfer of credit card balances. .

- Use a statute of limitations to eliminate old debts.

Why is the debt so bad??

If you have debt, it's hard not to worry about how you'll make your payments or how you'll avoid taking on more debt to make ends meet. The stress of debt can lead to mild to severe health problems, including ulcers, migraines, depression and even heart attacks.

What are the two types of debt?

There are two types of debt: Installment and revolving. Each has pros and cons.

What does your debt cost??

The cost of debt is one part of a company's capital structure, the other part is the cost of equity capital. Calculating the cost of debt involves determining the average interest paid on all of a company's debt.

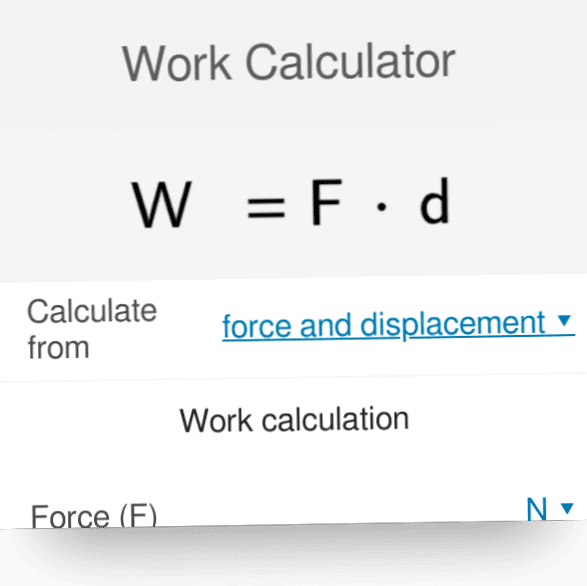

Work

How to calculate the work done??How to calculate the work on a calculator??What is work done equation?How to calculate the.

Cell

The main difference between synergid and oocyte is that synergid is a kind of supporting cell in the embryo sac, while oocyte is the female G.