The benefits from the old-age security systems and in particular the old-age pension from the statutory pension insurance are affected by reductions. Who wants to have higher income in old age, must provide privately.

The state therefore promotes supplementary funded provision. This means that you build up private capital in addition to your entitlements under the statutory pension scheme, which then flows back to you when you retire. And this capital accumulation is also promoted in many places.

End of the generation contract

The state interventions in the social system of the statutory pension insurance show effect. In principle, almost all plans and measures involve a partial departure from the intergenerational contract and the pay-as-you-go system. Within this scheme, in simple terms, the active employees finance the payments to the pensioners, the widows and widowers and the disabled in the same year.

There are many reasons for the problems of this system:

- The demographic development (decreasing birth rate, aging population,…),

- longer training periods,

- longer periods of unemployment and interrupted employment histories,

- as well as long pension payment duration due to increased life expectancy.

However, the idea of pay-as-you-go is not bad per se. The pay-as-you-go system in particular is inherently crisis-proof and also eliminates all investment risks that can be found in numerous private pension schemes. It is therefore advisable for everyone to select these private pension measures in a targeted manner and, above all, in line with their individual situation.

Pension level

What is shown to the employee again and again today is the further decrease of the statutory old-age pension. The net income of a "basic pensioner" is calculated as follows based on. The corner pensioner is an artificial figure who pays the average contribution to the statutory pension insurance for 45 years (based on the average income determined annually). However, this is not very likely in view of current employment and family biographies.

As a result, one can approximately assume a pension level after taxes of less than 50% of the former net salary. The difference between your income at retirement age and the expenses of your accustomed standard of living (if there is a shortfall) is referred to as the "pension gap".

Time is pension

The sooner you start saving of any kind, the higher the chance of achieving this if necessary. existing pension gap in old age to close. And the sooner you start, the lower the necessary savings rates.

Since inflation also ensures that assets lose value over time, the interest rate on the investment should be higher than this inflation rate.

Current situation

In the future, there will be a partial change in the system, which will further reduce the weight of the pay-as-you-go state pension system in the future as well. Private savings processes are therefore gaining in importance if more income is to be available in old age.

The state promotes these savings processes in the savings phase, but taxes the benefits in the pension phase – here, however, often with lower income and a corresponding tax rate.

Since the Retirement Income Act came into force in 2005, the old-age provision system has basically been divided into 3 layers:

- Basic pension provision, 1. Layer: statutory pension insurance, civil servant pension, occupational pension, agricultural pension fund, private basic pension. Contributions are becoming increasingly tax-privileged, while pensions are becoming increasingly taxable.

- Supplementary provision, 2. Layer: occupational pension, Riester pension. Contributions are tax-subsidized and/or allowances are granted. Pensions fully taxable.

- Investment products, 3. Layer: private pension insurance, other savings. Contributions are paid from taxed income. Annuities are tax-deferred.

You therefore have these three options for building up your funded pension provision.

Basic pension

State support for the basic pension is based on increasing tax deductibility of contributions and a simultaneous increase in the taxable portion of pension payments. At the end of this development, there should be full tax deductibility of contributions (in the accumulation phase) and full taxation of pension payments (in the pension withdrawal phase).

In addition, everyone can take advantage of the basic pension subsidy. For the self-employed in particular, this is the only way to build up a private pension plan with state support. But even for employees with high incomes, the basic pension can pay off. In many cases, the net expense is significantly reduced by the tax incentive.

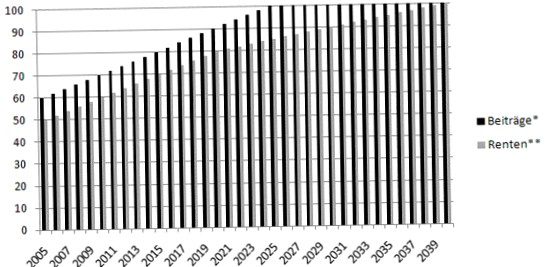

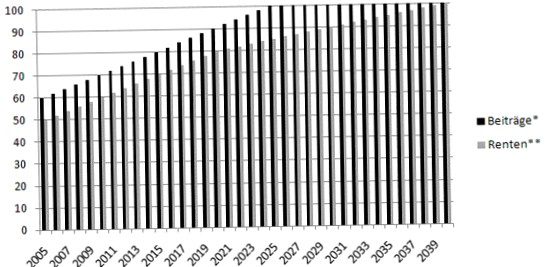

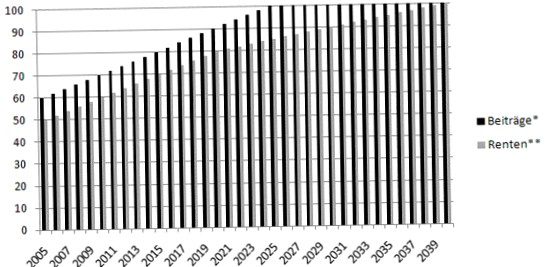

*Contributions: Contributions to a basic pension plan are tax deductible as part of the special expenses deduction. Since 2017, for single persons, a maximum of 23.362 euros can be used as a contribution. In 2005, 60% of the then still 20.000 euros is claimed – i.e. 12.000 euros. This percentage increases by 2% annually to 100% by 2025. In the case of jointly assessed spouses, these amounts are doubled.

** Pensions: In return, the pension benefits are subject to taxation on a pro rata basis. This percentage of the taxed portion of pension payments also increases slowly to 100% by 2040. Until 2020 in 2 % steps and from then on in 1 % steps.

Practical tip: Depending on the economic situation, additional payments can be made with a low contribution, which are then also tax deductible. This allows for a certain degree of flexibility, as decisions are made from year to year as to how much should be set aside for retirement.

The condition for this tax incentive is that the entitlements within a basic pension contract must not exceed

- inheritable,

- lendable,

- alienable,

- transferable

- or can be capitalized.

Also, payouts may not be inherited until age 60 at the earliest. The pension must be paid out before the age of 60.

Insolvency protection: Despite these relatively narrow limits, the basic pension is a sensible and worthwhile alternative, especially for the self-employed, since the assets are protected from third-party access during the savings phase. Neither insolvency administrators nor bailiffs can demand that your old-age provision be liquidated.

Conclusion: Despite the restrictions on disposal, the basic pension is an opportunity for you to reduce the tax burden in the employment phase and at the same time to build up an adequate old-age provision – even if the maximum tax limits of other old-age provision products have already been exhausted.

Riester pension

The 2. The second layer is the so-called supplementary pension. Within this, private Riester pensions and occupational pensions are combined. In the modular structure of the German old-age security system, therefore, the first supplement to basic provision.

The subsidy consists of either the payment of allowances or. the tax deductibility of the contributions made, within the framework of a special expenses deduction.

However, the Riester pension is not open to everyone. Thus, only certain groups of people are eligible:

- Compulsorily insured persons in the statutory pension insurance scheme

- compulsorily insured persons in the old-age insurance scheme for farmers

- Civil servants and recipients of official emoluments

- Spouses of beneficiaries who do not themselves belong to the group of persons eligible for subsidies

Insurers, banks, building societies and investment fund companies that offer Riester contracts must meet certain statutory requirements with these products (AltZertG) in order for them to be certified by the competent body and thus recognized as eligible Riester pensions. For example:

- At least the sum of contributions (personal contribution + allowances) at the start of the pension phase.

- Benefits may be paid at the earliest from the age of 62. The pension can be paid out before the age of 60 (exception: occupational groups for which the statutory pension insurance provides for an earlier pension start date). And a one-time lump-sum payment of 30% of the contract balance is possible without loss of the subsidy.

- The benefit must take the form of a lifelong pension payment. Either directly as a lifelong annuity or as a payout plan in conjunction with an annuity from the age of 85. age.

The allowances are broken down as follows:

- Basic allowance for single persons: 154 euros (and one-time 200 euros if under 25 years of age)

- basic allowance for married couples: 308 euros

- Child allowance: 185 euros

- Child allowance for children born from 2008: 300 euros

However, in order to receive the full subsidy, the legislator requires a minimum amount of 4% of the previous year's income subject to social insurance contributions. Also, a basic contribution of 60 euros per year must not be undercut.

In addition to the subsidies, there is also the tax side of the Riester pension. This provides for a special expense deduction of a maximum of 2.100 euros. However, the allowance is deducted from this tax saving.

Conclusion: Families in particular benefit from the allowances. And for eligible single people with children, the Riester pension is often a sensible supplement to statutory provision. The special design of the subsidy, however, requires constant monitoring of the circumstances and, if applicable. a contract adjustment.

Company pension scheme

Within the 2. layer, private Riester pensions and occupational pensions are combined.

In the company pension scheme, there is a clear separation between the labor law side and the i. d. R. Insurance-type financing models and their set of terms and conditions instead of. A distinction must also be made as to whether the entitlements to a company pension scheme

- Are funded by the employer

- or by the employee if he or she forgoes future salary components (deferred compensation).

In principle, five implementation channels are available to both the company and the employee, with some special features*:

* Important: This overview only serves as a rough guide within the possible implementation paths. For the sake of a better overview, we have shortened or not shown some specifics at all.

As an employee, the company pension plan is also considered in the context of deferred compensation due to the tax and social security exemption (§ 3.63 EStG) in the accumulation phase is one of the most efficient pension measures. In addition, as an employee you have a legal entitlement to a company pension (deferred compensation, § 1a BetrAVG).

Investment and other pension products

In the 3. layer, we have included all other investment and other pension products that do not comply with the 1. or 2. Layer belong.

In principle, the products of the 3. layer not specifically subsidized. Contributions will also be paid from existing net income or. paid from private assets. In return, however, the benefits i. d. R. taxed at a reduced rate. In the case of private pension insurance, for example, with the income share: Here, only a (fictitious) part of the pension benefits is subject to individual taxation (§ 22 EStG).

Important: Old life insurance policies are subject to grandfathering. If you took out a classic endowment insurance policy before 2005, the payout will remain tax-free in the future as well.

Conclusion: The 3. layer and thus the investment and other pension products that serve to supplement old-age provision are more attractive due to the lack of restrictions i. d. R. Much more flexible than the variants of the 1. and 2. Layer.

Furthermore, products such as term life insurance, occupational disability insurance or long-term care pension insurance are included in the 3. Layer.

"longevity risk."

The market for pension products has been in constant flux since the mid-1990s. Banks, insurers and fund companies have developed solutions, each with its own advantages and disadvantages.

The goal of retirement planning should be annuity payments that accrue to you for life. This would be the case, for example, with the statutory old-age pension or private or occupational pensions granted for life, which are at least. be paid until the death of the insured person. Technically, this is called "longevity risk" described. Meant with "risk, that payout plans end or accumulated capital is used up before death.

The agony of choice

In terms of achieving a lifelong pension, there are basically only two options to choose from. On the one hand, traditional pension insurance and, on the other, unit-linked pension insurance. While the classic form already guarantees benefits upon conclusion of the contract, the unit-linked variant lacks this – however, the latter is significantly more flexible in terms of capital investment.

Classic pension insurance

The classical pension insurance stores the premiums of the policyholders in the sog. cover pool and invests them according to fixed investment restrictions for the most part in fixed-interest securities. This results in a steady but very low performance for the customer – but in case of doubt, it is still better than a 20% loss in value.

An annuity insurance already promises a guaranteed lifelong pension to a policyholder when the contract is concluded. To represent this guarantee over decades, became with the capital market situation the last years more heavily. In addition, life expectancy has increased over the past decades, resulting in lower guaranteed pensions than would have been the case 20 years ago.

Classic annuities always enjoy particular popularity when the accumulation phase is comparatively short or has to be. So, for example, if only 1 to 15 years remain until retirement or existing capital is to be converted directly into an annuity payment.

- Guaranteed minimum interest rate

- Investment restrictions

- Capital investment at the risk of the insurer

- "Longevity risk" covered

- Amount of pension benefit already guaranteed at the conclusion of the contract

- Increasing performance through surplus (calculation buffer)